- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- March 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- January 2024

- December 2023

-

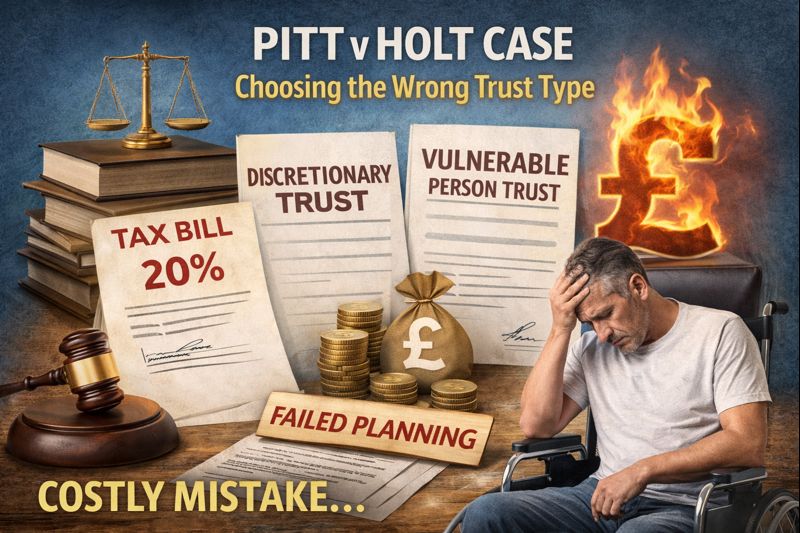

Vulnerable Person Trusts vs Discretionary Trusts: What’s the Difference and Why It Matters.

Choosing the wrong type of trust can have serious and expensive consequences. The Supreme Court case of Pitt v Holt is a powerful example of how well intentioned planning went badly wrong. Personal injury compensation was placed into a discretionary trust to protect benefits, but the trust triggered an unexpected and substantial tax charge that…

-

How Vulnerable Person Trusts Can Protect Benefits and Long Term Security

A Vulnerable Person Trust can be the difference between meaningful support and an expensive mistake. Many people don’t realise that leaving money directly to a vulnerable person can result in the loss of vital means tested benefits. This type of trust allows funds to be used for someone’s benefit without being treated as theirs, protecting…

-

Trusts and Estate Planning

What trusts are available, what they do, and when they make sense Trusts are not about hiding money or playing games with HMRC. Used properly, they are legal tools that help people control who benefits from their assets, when they benefit, and on what terms. Used badly, they are expensive disappointments. Below is an overview…

-

Your Will Doesn’t Control Everything!

Most people assume their will controls everything after death. It doesn’t. Many assets pass automatically outside the estate — including property, pensions, and joint accounts — often overriding the will entirely. This article explains what bypasses probate, why families are often shocked, and how proper estate planning brings everything back into line.

-

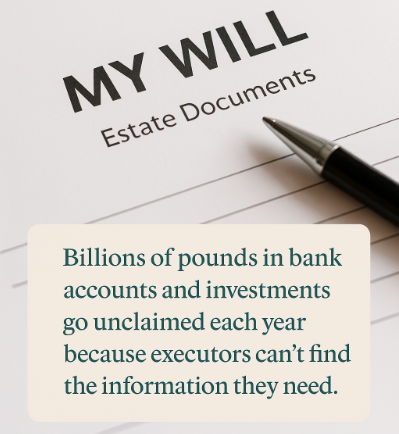

Make Life Easier for Your Executors!

Billions of pounds in bank accounts and investments go unclaimed each year because executors can’t find the information they need. Our guide explains what to keep with your will — so your estate reaches the right hands, not the government or the banks.

-

Trust, Power, and Oversight: What Harold Shipman Taught Us About Professional Integrity

Few names in modern British history provoke as much horror and introspection as Harold Shipman. A respected GP in a quiet English town, he was also one of the most prolific serial killers in recorded history. His crimes didn’t just shock the public, they dismantled faith in professional self-regulation and forced every profession, from medicine…

-

From Dreamvar to Digital ID: When Protection Becomes Control

Anyone who’s ever bought or sold a property has probably felt that twinge of frustration when their solicitor asks, yet again, for more ID. Proof of address. Proof of funds. Source of funds. Bank statements. Then, sometimes, the same all over again. It’s easy to wonder: why all the fuss? The answer lies in one…

-

The Curtain Principle and Why Beneficiaries Need More Than Just a Form A

In English land law, the curtain principle is a cornerstone of the land registration system. It makes life simple for buyers but creates a challenge for beneficiaries who want to safeguard their interests. Let’s unpack how it works and why a standard Form A restriction is often not enough protection. The Curtain Principle – Hiding…