Secure Your Business Future with a Business Will: Key Reasons and Benefits

As a business owner, you have invested substantial time, effort, and resources into building your company. However, one crucial aspect often overlooked is the need for a business will. At Conwy Wills and Trusts, we understand the significance of safeguarding your hard-earned legacy, and a business will is a fundamental tool in achieving this. Here’s why having a business will is essential for every business owner.

Ensuring Continuity and Stability

One of the primary reasons to have a business will is to ensure the continuity of your business operations. Without a clear succession plan, your business may face significant disruptions or even closure upon your passing. A business will provides clear instructions on who will take over the management and ownership of your company, ensuring that it continues to run smoothly without unnecessary interruptions.

Protecting Your Family and Beneficiaries

A business will is not just about protecting your business; it’s also about protecting your family and loved ones. By specifying how your business assets will be distributed, you can ensure that your family is provided for according to your wishes. This can prevent disputes among heirs and reduce the stress and uncertainty they may face during an already difficult time.

Minimising Tax Liabilities

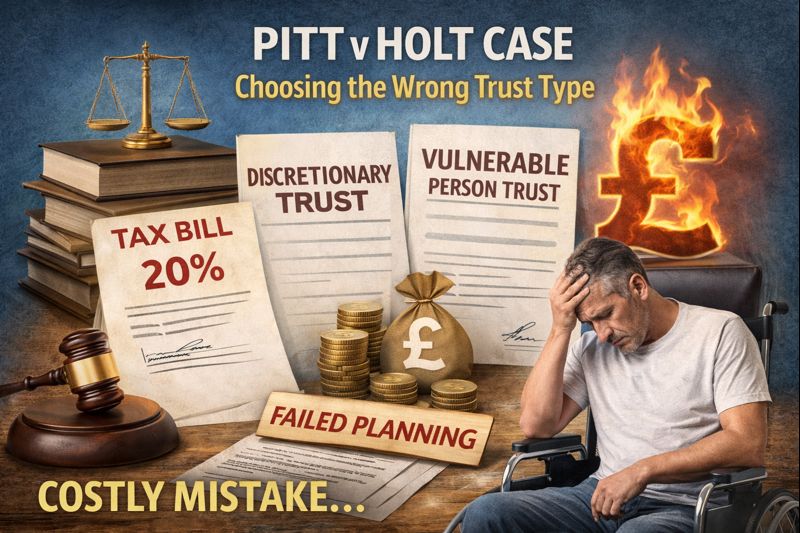

Proper estate planning through a business will can help minimise the tax liabilities associated with the transfer of your business assets. By structuring your will in a tax-efficient manner, you can ensure that more of your business’s value is preserved for your beneficiaries. This can include strategies such as setting up trusts or taking advantage of business reliefs and exemptions.

Preserving Business Value

A business will allows you to plan for the preservation of your business’s value. This includes appointing a capable successor who understands your business and is prepared to maintain or grow its value. Additionally, you can include provisions for the retention of key employees, who are often essential to the ongoing success of your business.

Preventing Legal Disputes

The absence of a business will can lead to legal disputes among potential heirs and stakeholders. Such disputes can be costly and time-consuming, potentially damaging the reputation and financial stability of your business. A well-drafted business will provides clear directives that can prevent conflicts and ensure a smooth transition of ownership and management.

Customising Your Succession Plan

Every business is unique, and a business will allows you to tailor your succession plan to fit your specific needs and goals. Whether you want to pass your business on to a family member, sell it, or appoint an external manager, a business will gives you the flexibility to make decisions that align with your vision for the future of your company.

Peace of Mind

Finally, having a business will provides peace of mind. Knowing that you have taken the necessary steps to protect your business and your loved ones can give you confidence and peace, allowing you to focus on running your business without the worry of what will happen after you’re gone.

Should You Incorporate a Business Will into Your Overall Will?

Advantages:

- Unified Estate Planning:

- Having a single document that covers both personal and business assets ensures a cohesive estate plan. This can simplify the administration process for executors and beneficiaries.

- Clear Instructions:

- It provides a comprehensive set of instructions in one place, which can reduce the risk of conflicting directives and streamline the probate process.

- Legal Clarity:

- Including the business provisions in the main will can ensure they are subject to the same legal scrutiny and protections as the rest of the testator’s estate.

Disadvantages:

- Complexity:

- The main will may become lengthy and complicated, especially if the business affairs are intricate, potentially making it harder to understand and execute.

- Privacy Concerns:

- Wills are generally public documents once they go through probate. Including sensitive business information in the will might expose details that the testator would prefer to keep private.

Creating a Separate Business Will

Advantages:

- Specialisation:

- A separate business will can focus solely on the business aspects, allowing for more detailed and specific instructions regarding the management, succession, and disposition of business interests.

- Privacy:

- A separate business will may offer better privacy for business affairs, especially if it can be kept out of the public record through mechanisms such as trusts.

- Flexibility:

- It allows for the business succession plan to be updated independently of the personal estate plan. This can be beneficial if the business environment changes frequently.

Disadvantages:

- Coordination:

- Having two separate documents requires careful coordination to ensure there are no conflicting instructions between the personal will and the business will.

- Legal and Administrative Complexity:

- The existence of multiple documents can complicate the legal and administrative processes, potentially leading to higher costs and a longer probate process.

At Conwy Wills and Trusts, we specialise in creating comprehensive business wills that reflect your unique circumstances and wishes. Our experienced team can guide you through the process, ensuring that your business will is tailored to protect your legacy and provide for your family’s future. Contact us today to learn more about how we can help secure the future of your business.

1 comment