Judicious Encouragement and Protecting Inheritance from Divorce

For clients creating wills, it’s common to leave assets first to a spouse and then to children in equal shares. Yet, when concerns arise about the risk of a child’s inheritance being exposed to a future divorce settlement, straightforward provisions may not offer the necessary protection. In such cases, families should consider advanced planning to safeguard their inheritance from potential claims.

The Problem: Protecting Against Divorce Settlements

In a typical will, an outright gift to a child can be problematic if the child goes through a divorce. An inheritance is typically considered a personal asset. However, in divorce proceedings, it can be subject to division if courts view it as a financial resource available to one of the spouses. Once an inheritance is received outright, it can be pooled into marital assets, putting it at risk in a divorce.

Common Missteps: “Gifting Through Siblings”

One strategy clients occasionally propose is leaving the inheritance to siblings with an understanding that it will be passed to the divorcing child after proceedings conclude. However, this arrangement has serious pitfalls:

- No Legal Obligation: There’s no enforceable duty on siblings to “return” the inheritance, creating a risk of conflict and potential litigation.

- Risk of Misunderstandings: Without legally binding arrangements, these informal agreements may fall apart or fail to support the intended recipient effectively.

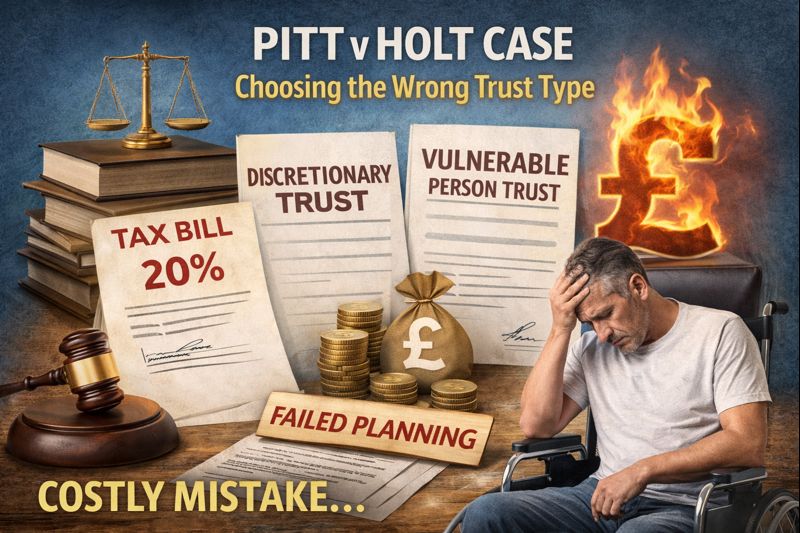

A Practical Solution: Discretionary Trusts

To protect against divorce claims, practitioners often recommend establishing a discretionary trust for the child’s inheritance. Here’s why a discretionary trust is beneficial:

- No Automatic Right to Inheritance: In a discretionary trust, the child has no guaranteed right to the assets. Distributions are entirely at the discretion of trustees, limiting any legal claim a spouse may have on the trust’s assets.

- Trustee Control and Letter of Wishes: The trust’s assets can only be distributed per trustee decisions, often guided by a letter of wishes from the settlor. This flexibility can prevent any “right to claim” in a divorce.

- Future-Proofing Against Divorce: Since the child has a mere “hope” of receiving an inheritance rather than a legal right, the trust assets typically remain protected from being listed as marital property in divorce proceedings.

Is It Foolproof? Understanding Judicious Encouragement

Historically, the courts have sometimes exercised judicious encouragement, an approach where the court might “encourage” trustees to release funds to a divorcing beneficiary. This tactic leverages the notion that if a potential beneficiary could expect trust funds, they might reasonably request it during divorce.

However, recent case law has shown a more protective stance towards discretionary trusts, underscoring their effectiveness in inheritance planning:

- Judicial Precedents:

- Charman (2007): The court questioned whether trustees might distribute funds in the foreseeable future. This led to scenarios where trustees, faced with a request under divorce, might release assets due to court influence.

- Ipecki v McConnell (2019): In this case, the court found that since the discretionary trust had previously supported the beneficiary, it might reasonably continue doing so. This reliance on past distributions underscores the importance of trustee conduct and distribution history.

- Daga v Bangur (2019): This more recent case shifted the landscape, as the court ruled against enforcing judicious encouragement. Trustees who stood firm against “encouragement” could not be legally forced to comply with court suggestions, marking a potential end to this form of judicial leverage.

Practical Recommendations for Clients

For clients wary of inheritance exposure to divorce, a discretionary trust remains one of the most robust tools. However, a few additional steps may further strengthen this protection:

- Consider a Life Interest Trust: In some cases, setting up a life interest trust with income distributions to the child can help preserve the capital, while ensuring the child has access to financial support.

- Pre-Nuptial Agreements: If a child is not yet married, discussing pre-nuptial agreements may be prudent. A legally binding agreement can delineate personal and marital assets, offering a layer of security.

- Trustee Conduct and Distribution Strategy: Trustees should exercise discretion carefully, especially if a distribution history may be scrutinised. Avoiding regular distributions can strengthen the perception that the child has no de facto control over the trust assets.

Costs and Limitations of Court Proceedings

Litigation surrounding discretionary trusts can be costly, and the potential for a successful claim may be limited by the availability of substantial assets. For families with significant estates, the potential legal costs involved may serve as a deterrent to claims, supporting the effectiveness of the discretionary trust as a protective measure.

Conclusion

Discretionary trusts offer strong protection for children’s inheritances against divorce claims, though it’s important to approach this with nuance and legal expertise. Clients concerned about safeguarding their legacy should consider incorporating discretionary trusts into their wills, alongside other estate planning strategies to bolster protection. With the right planning, these trusts can provide peace of mind and ensure that inheritances fulfil their intended purpose for generations to come.

With thanks to Paul Tansley of the IPW for his technical piece regarding this issue.